nj ev tax credit 2020

2 300 X 5 1500. The results for New Jersey are a stronger economy less pollution lower costs and reduced demand for electricity.

Southern California Edison Incentives

2 - There is also a 500 rebate for home EV charging infrastructure.

. The bill was signed into law and took effect on January 17th 2020. Thousands of New Jersey homeowners businesses and. Some of the most popular.

For those not familiar with New Jerseys EV program. The state already waives its 6625 sales tax for such purchases and the federal government offers an income tax credit of up to 7500 based on battery capacity and model. New Jersey has emerged as a national leader in this market offering rebates of up to 5000 cash for eligible electric vehicles.

Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as. In January 2020. To ease range anxiety New Jersey has also launched a program to install hundreds more charging stations throughout the state doubling the number of places motorists can go to recharge their.

In 2019 around 329000 electric vehicles were sold according to the US. The 30C credit covers up to 30 or 30000 of the up-front costs for purchasing and installing EV charging infrastructure and equipment for qualified properties and businesses. New Jersey STATE INCENTIVES.

After that the credit phases out completely. New Jersey was offering money back but that program expired. On January 17 2020 Governor Murphy.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year. But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can get as much as 12500 off. New Jersey has the worst ratio of electric vehicles to charging stations.

E-tron Sportback 2020-2022 7500. Your NJEITC is 600. EV charging infrastructure is a significant.

The below programs are designed to encourage EV adoption in New Jersey which is crucial to reaching a 100 clean energy future. However the 2020 electric car market share increased some. The New Jersey Board of Public Utilities offers state residents a rebate in the amount of 25 per mile of EPA-rated all-electric range up to 5000 to purchase or lease a new PEV with an MSRP of 55000 or less.

The New Jersey Board of Public Utilities has engaged the. 3 - EVs are no matter the MSRP exempt from NJ sales tax. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

Those with a manufacturers suggested retail price from 45000 to 55000 receive a 2500 incentive and those selling for less than 45000 receive 5000. According to the Department of Environmental Protection the New Jersey ZEV exemption program. Plug-In Electric Vehicle PEV Rebate Program.

From April 2019 qualifying vehicles are only worth 3750 in tax credits. And the federal government offers a 2500 to 7500 income tax. 0 0 You Save 5300 79990 Tesla 2021 Model S Plaid.

The new incentive program offered a point-of-sale rebate of up to 500000 on the purchase or lease of a new electric vehicle. The NJCEP offers financial incentives programs and services for New Jersey residents business owners and local governments to help them save energy money and the environment. 15 Tax Calculators 15 Tax Calculators.

Yes the state of New Jersey has a tax credit for electric car drivers. Tesla 2021 Model Y long range AWD 326. A new EV tax credit in the Build Back Better Act will greatly incentivize electric vehicle sales.

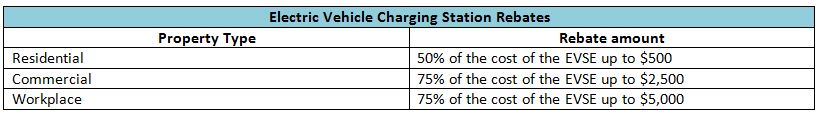

0 You Save 7425 112090. Ad New Jerseys DriveGreen Program offers Level 2 and DC Fast Charger incentives. TRENTON - The New Jersey Board of Public Utilities NJBPU opened Year 2 of its Charge Up New Jersey electric vehicle EV incentive program today taking one more step toward the Murphy Administrations goal of getting 330000 EVs on the road by 2025.

Nj ev tax credit 2020 Thursday May 12 2022 Edit. So if you are waiting to buy a Tesla. 1 3600 12 300.

With this rebate level weve hit the rate of sales. Nissan is expected to be the third manufacturer to hit the limit but. 3 1500 x 40 600.

The New Jersey Treasurys website was recently updated with a complete list of all 2019 vehicles that qualify. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022. PEVs must be purchased or leased after January 17 2020.

E-tron SUV 2019 2021-2022 7500. Your federal EITC is 3600. Tesla 2021 Model S long range 412.

The 2020 30C Federal Tax Credit has been extended through 2021 which opens the door for substantial savings on EV charging. Available until January 1. I3 Sedan 2014-2021.

The New Jersey Sales and Use Tax Act provides a Sales and Use tax exemption for zero emission vehicles ZEVs certified to meet the California Air Resources Board zero emission standards for a particular model year. However this does not apply to Plug-in Electric Vehicles PEVs. Rebates may be limited to one award per person.

At first glance this credit may sound like a simple flat rate but that is unfortunately not the case. Answered on Mar 17 2022. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives.

Offset the cost of your EV charging station project with state and utility programs. TRENTON - Governor Phil Murphy today announced that the electric vehicle EV incentive legislation signed into law three weeks ago became effective on January 17 2020 the day the bill was signedVehicle owners who purchased eligible electric vehicles starting on January 17 are eligible for the rebate. 2021 Tax Year Return Calculator in 2022.

4825-1 et seq and signed by Governor Murphy on January 17 2020. 1 - Theres now a 5000 rebate for EVs with an MSRP under 55000. Plug-In Electric Vehicle PEV Tax Credit.

These prices slightly to accommodate the 55000 limit for tax credit since Extended Range is a popular choice for EV. Then from October 2019 to March 2020 the credit drops to 1875. Calculate your NJEITC as follows.

The plug-in hybrid electric vehicle rebate expires December 31 2022 and. Charge Up New Jersey. Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase. Zero Emissions Vehicle ZEV drivers are exempt from the NJ sales tax. New Jersey just restarted its electric vehicle incentive program.

The exemption is NOT applicable to partial.

Rebates And Tax Credits For Electric Vehicle Charging Stations

Additional Incentives Charge Up New Jersey

New Jersey Solar Incentives Nj Solar Tax Credit Sunrun

Additional Incentives Charge Up New Jersey

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Electric Motorcycle Incentives Harley Davidson Of Ocean County Nj

Electric Car Tax Credits What S Available Energysage

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

N J Drivers Miss Out On 5k Rebate For Electric Cars If They Bought Them Earlier This Year Nj Com

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Phase One Of Charge Up New Jersey Ev Incentive Program Complete T D World

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Latest On Tesla Ev Tax Credit March 2022

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

N J Wants To Pay You To Buy An Electric Vehicle But It Hasn T Said When It Will Resume Doing So Nj Com

Rebates And Tax Credits For Electric Vehicle Charging Stations